Section 1244 stock gain 2017 trial#

Citation to district court opinions makes sense as it is the trial court that is making the evidentiary decision. The Tax Court has begun citing district court opinions, often from the jurisdiction to which the case would be appealed, and to relevant appellate court opinions to support its evidentiary decisions. As a corollary to the statutory amendment, there seems to be a new evidentiary trend. The PATH Act changed the statutory language, removing the reference to the District Court for the District of Columbia. It could have meant anything from applying the rules of evidence as adopted by the District of Columbia's District Court, as interpreted by the District of Columbia's District Court, as interpreted by the Circuit Court of Appeals for the District of Columbia, or something else. How the reference to the District Court for the District of Columbia should be interpreted was never certain. Before the PATH ACT, under section 7453, the Tax Court conducted trials in accordance with the rules of evidence applicable in trials without a jury in the District Court for the District of Columbia. The Federal Rules of Evidence establish the guidelines a judge will use to determine what testimony and documents will be admissible in evidence in the Tax Court. The first Part of the Article covers some 2015 legislative changes made by the Protecting Americans from Tax Hikes Act (PATH Act). This Article provides updates discussed in the Guide and an excerpt from the Guide. Have an accounting or bookkeeping question? Email it to me.The American Bar Association Tax Section has recently published the second edition of A Practitioners Guide to Tax Evidence (the "Guide").

Section 1244 stock gain 2017 code#

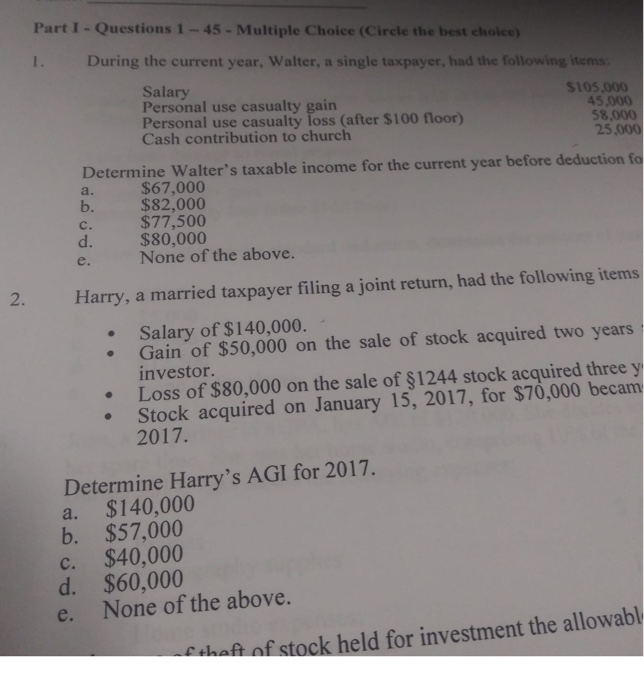

To receive the tax benefit of Section 1244, the Code prescribes specific requirements for: However, while a loss on Section 1244 stock is treated as an ordinary loss, the deduction is limited to the amounts stated above.

Note that ordinary losses are noramally 100% deductible. Any excess over $3,000 must be carried over to the next year.Ī loss on Section 1244 stock, on the othe hand, is deductible as an ordinary loss up to $50,000 ($100,000 on a joint return, even if only one spouse has a Section 1244 loss). The general rule for net capital losses (losses that exceed gains) is that they are subject to an annual deduction limit of only $3,000. Normally, stock is treated as a capital asset and if disposed of at a loss, the loss is deducted as a capital loss. Section 1244 of the Internal Revenue Code is the small business stock provision enacted to allow shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than as a capital loss, which is limited to only $3,000 annually.

0 kommentar(er)

0 kommentar(er)